You Could Eliminate Every Federal Department, Agency And Employee Including The Military And Still Not Be Able To Balance The Budget

Since 1963 through 2022, the percent growth of revenues has averaged 6.9 percent a year to its present level of $4.65 trillion, according to data compiled by the White House Office of Management and Budget.

In the meantime, mandatory spending including net interest owed on the national debt has grown an average 8.87 percent a year to its current level of $4.64 trillion.

And discretionary spending has grown an average 5.5 percent a year to its current level of $1.735 trillion.

Will this presidential election be the most important in American history?

Therefore, the ballooning budget deficit is not purely a matter of fiscal discipline.

When it comes to the spending Congress has control over, the spending it actually votes on, including wars, stimuli and supplementals — so-called discretionary spending — it has grown less on an annual basis than revenues.

That is a function of the bicameral system, and also two-party rule in Washington, D.C. including various feuds between Democrats and Republicans over the size and scope of spending, plus occasional party-infighting in cases of one-party rule in Congress, making it difficult to pass anything, and so Congress just tends to copy and paste annual spending each year with nominal increases that have accounted for less than the growth of revenue.

In fact, since 2011, when Republicans took control over the House from Democrats after the financial crisis, and instituted budget sequestration — which will once again go into effect on April 30 after the 2023 debt ceiling deal — discretionary spending has only grown 1.99 percent a year.

Meanwhile, since 2011, mandatory spending grew an average 7.7 percent a year.

And revenues grew an average 7.26 percent.

Meaning, despite more fiscal discipline than ever including two sequestrations in less than 20 years, the budget deficit has never been larger.

In fact, the entire discretionary budget of $1.736 trillion for 2023 could be eliminated right now — eliminating every department, agency and firing every federal employee including the military — and the budget would still not be balanced as the $34.1 trillion national debt grew by $1.855 trillion in 2023.

Put another way, the nation’s annual borrowing accounts for 106.8 percent of all discretionary spending.

And so, no tinkering around the edges of the appropriations process, which only impacts discretionary spending can ever do a thing to reduce the deficit, including with the imminent spending freezes of sequestration.

It’s all mandatory spending. Social Security will grow from $1.346 trillion to $2.37 trillion in 2033 amid the Baby Boomer retirement wave, a 76 percent increase.

Medicare will grow from $821 billion to $1.84 trillion, a 124 percent increase.

Medicaid will grow from $608 billion to $928 billion, a 52 percent increase.

These are the drivers of the budget, account for 52 percent of all federal spending by 2033. Once interest and other mandatory spending is accounted for, mandatory spending will account 77.8 percent of all federal spending, up from its current level of 72.7 percent.

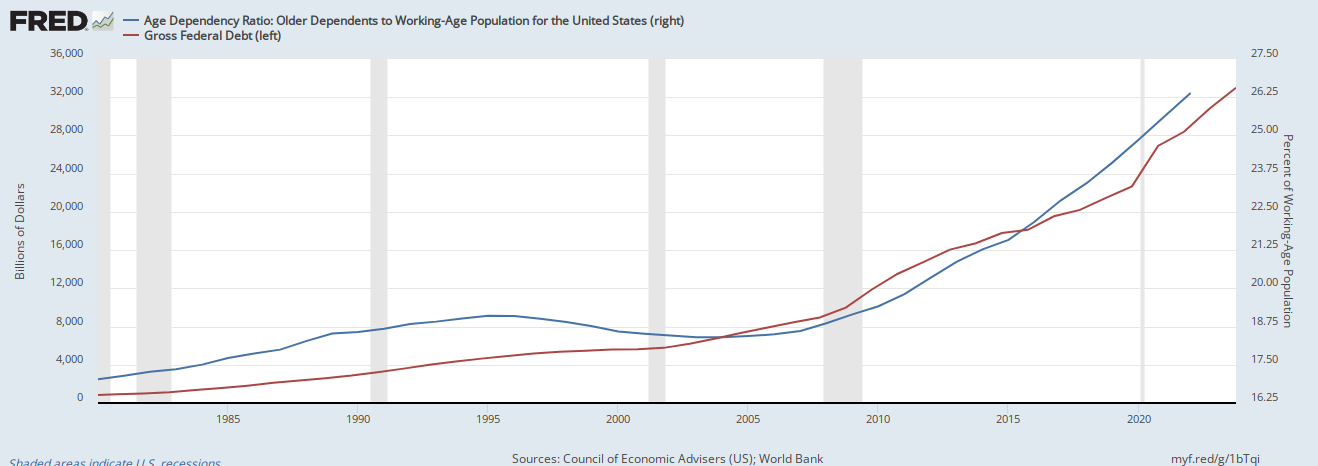

The reason is simple, as the percentage of the working age population over the age of 65 continues to rapidly increase — since 1960, when the FDA approved birth control, it has gone from 16 percent of the population to 26 percent of the population — and with it the $34.1 trillion (and rising) U.S. national debt, data from the World Bank and the U.S. Treasury shows.

At the same time, as the growth rate of the working age population participating in the civilian labor force has dramatically slowed down thanks to plummeting fertility, so has nominal economic growth, Bureau of Labor Statistics and Bureau of Economic Analysis data shows.

There are two simultaneous outcomes that emerge. First, as the population rapidly ages, so too do Social Security, Medicare and Medicaid expenditures that seniors depend on explode.

In the meantime, thanks to slower growth, revenues will continue not to keep pace with expenditures. Revenues will increase from $4.6 trillion in 2023 to $7.4 trillion, a $2.5 trillion or 51 percent increase over ten years. But expenditures will grow even faster, with outlays growing from $6.37 trillion in 2022 to $9.9 trillion by 2033, a $3.7 trillion or a 55.4 percent increase over the next decade.

The White House Office of Management and Budget projects the national debt to skyrocket to more than $50 trillion by 2033, but that’s low-balling it. The debt has grown by about 8 percent a year since 1980 once recessions and wars are factored. At that rate, it should be about $65 trillion to $70 trillion by 2033 and $100 trillion by 2037 or so, well north of 200 percent debt to GDP.

The reason is because there are comparatively fewer taxpayers versus those receiving benefits as the structural deficit widens due to the drop in fertility, from 3.6 babies per woman in 1960 to 1.6 babies per woman in 2021 after birth control was approved by the FDA in 1960.

Fewer babies equals fewer workers who pay taxes. The more people who retire, the more we spend, and the fewer people working per retiree, the more we borrow. It’s that simple

Yes, life expectancy has increased, but that would have mattered less if the Baby Boomers, Generation X and Millennials simply had more children, which would have meant more taxpayers.

As it is, Congress is catering to constituencies committed to reproductive rights and replacing our unreproductive native population with millions of new illegal immigrants, rather than have a discussion particularly with single women about the pressing need for new families to be created, in the meantime pretending mightily that the debate over discretionary spending in the appropriations process is still relevant.

For Republicans and conservatives avoiding this discussion, two outcomes appear very likely as the national debt balloons, that is, failing to find enough new taxpayers to pay for entitlements, Congress will eventually move to raise taxes significantly to punitive levels and let in millions of more illegal immigrants to offset our demographic decline — and likely still be unable to balance the budget.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Cross-posted with The Daily Torch

Related:

- The IRS Has Not Recovered Even 1/16th of Its Outrageous $80 Billion Budget in New Taxes

- Liberty Report: Guerilla Warfare In The GOP: House Erupts Over Budget Bust-Up (Video)

- Biden Tries to Sneak Provision into Budget that would Eliminate ICE Agents, Excuse Criminal Illegals

- Biden’s “Excessive” Budget Proposal To Drive National Debt To $51 Trillion Over The Next Decade (Video)

- The Biden 2022 Discretionary Budget Request – Are Your Gun Rights at Stake?

Turn your back on Big Tech oligarchs and join the New Resistance NOW! Facebook, Google, and other members of the Silicon Valley Axis of Evil are now doing everything they can to deliberately silence conservative content online, so please be sure to check out our MeWe page here, check us out at ProAmerica Only and follow us at Parler, SocialCross, Speak Your Mind Here, and Gab. You can also follow us on Truth Social here, Twitter at @co_firing_line, and at the social media site set up by members of Team Trump, GETTR.

Give a middle finger to unaccountable global censors and big tech fascists. Bookmark this site, sign up for our newsletter, and check back often.

While you’re at it, be sure to check out our friends at Whatfinger News, the Internet’s conservative front-page founded by ex-military! And be sure to check out our friends at Trending Views:

And be sure to check out our friends at Trending Views: